User Tools

Major Purchases

Help with This Page:

This is the screen where you can describe the details of any major purchases you plan to make. A “major purchase,” also known as a “fixed asset” or “tangible asset” or “non-current asset,” is any item owned by the company that cannot be converted easily into cash, and is used by the company over multiple years to help it generate revenue. Examples include

- Office furniture such as desks, chairs, file cabinets, reception room furniture, and so on.

- Information technology equipment such as laptops, servers, networks, and so on.

- Real estate (land and buildings) for offices, retail space, warehouses, manufacturing, etc.

- Machinery for manufacturing.

In addition, the cost of filing for patents falls into this category because (a) it costs a lot, and (b) its value spans many years. Thus,

- Patent fees and associated attorney fees.

The reason this screen and its associated assumptions exist is because generally accepted accounting principles (GAAP) do not allow you to deduct the cost of these items from your revenues in the year they are incurred. So, for example, let's say in some year, your company has booked $500,000 in revenues and incurred $300,000 in expenses. In addition, it made a major purchase of manufacturing machinery for $280,000. You are not allowed to subtract that $280,000 from the year's revenue less expenses and claim a loss of $80,000 (i.e., $500,000 minus $300,000 minus $280,000). Instead, such a major purchase must be expensed over the period of its useful life; this annual expense is called depreciation. Although the Internal Revenue Service allows for many ways to spread that depreciation over the useful life, Offtoa assumes straight-line depreciation in all cases for the sake of simplicity; that is, we will assume that if machinery worth $280,000 has a useful life of, say, 7 years, it will be depreciated by exactly $40,000 each year for 7 years. As a result, in the year that the equipment is purchased, your company will subtract $40,000 of depreciation from the year's revenue less expenses and claim EBIT of $160,000 (i.e., $500,000 minus $300,000 minus $40,000). And for the next 6 years, your company will be able to subtract an additional $40,000 from its EBIT.

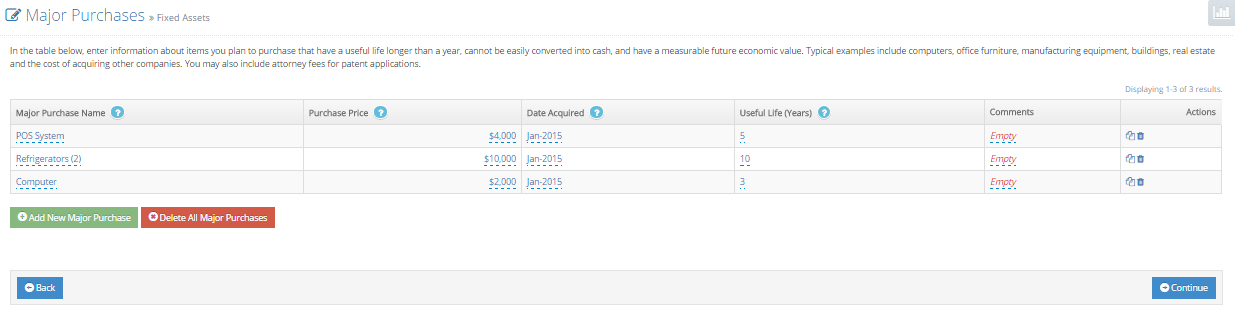

Here is what the screen looks like:

The key data items you should capture in your assumptions for every major purchase are

- Name of item. What is it that you plan to purchase? Computer? Laptop? Printer? Extruding machine? Locomotive? If you have a set of similar items that you are purchasing at one time with the same life time, feel free to group them together.

- Date of purchase. When do you plan to purchase the item(s). Please note that a company cannot purchase anything until it is a company. So make sure this date is later than the date of corporate formation.

- Purchase price. This is the total price you plan to pay for the item(s).

- Useful life (in years). For how many years do you believe this item will be useful? If less than 2 years, it is not a fixed asset; it is just an expense; in this case, record it as an “other expense,” not a “major purchase.” Unless you have good reason to believe that your company will be using an item in a manner quite unique from all other companies, we would suggest that you follow Internal Revenue Service's Publication 946's guidance on useful life of items commonly purchased by businesses (see table below).

| Business Equipment | Useful Life |

| Tractors | 3 years |

| Qualified Rent-to-Own Property | 3 years |

| Cars, Taxis, Buses & Trucks | 5 years |

| Office Machinery, Computers & Peripheral Equipment | 5 years |

| Research Equipment | 5 years |

| Appliances, Carpet, Furniture in Rental Property | 5 years |

| Solar & Wind Energy Property | 5 years |

| Office Furniture | 7 years |

| Agricultural Machinery/Equipment | 7 years |

| Vessels, Barges, Tugs, etc. | 10 years |

| Fruit- or Nut-Bearing Trees/Vines | 10 years |

| Land Improvements (e.g., Fences, Roads, Sidewalks, Bridges) | 15 years |

| Fuel Outlets & Convenience Stores | 15 years |

| Restaurants | 15 years |

| Farm Buildings | 20 years |

| Water Utility Property | 25 years |

| Residential Real Estate | 27.5 years |

| Nonresidential Real Estate | 39 years |