User Tools

Other Expenses

Help with This Page:

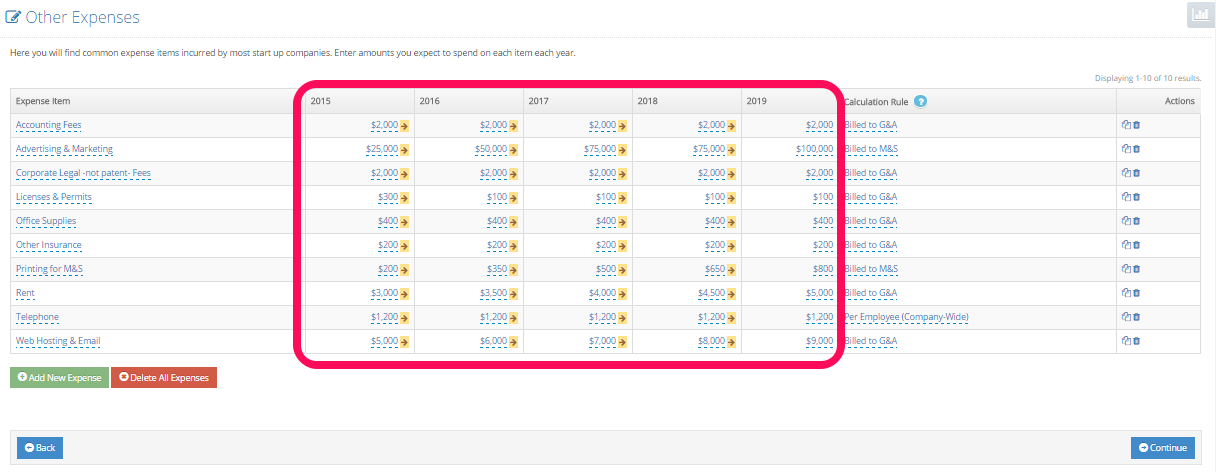

This is the screen where you enter all the expenses that you expect your company to have. Filling in this table of numbers may seem like a lot of work, but it won't take much time, and doing so will (a) make you look a lot more credible to investors, lenders, and other third parties, and (b) make life a lot easier for you during the next phase of your company.

For each expense, fill in the amounts you expect to spend each year:

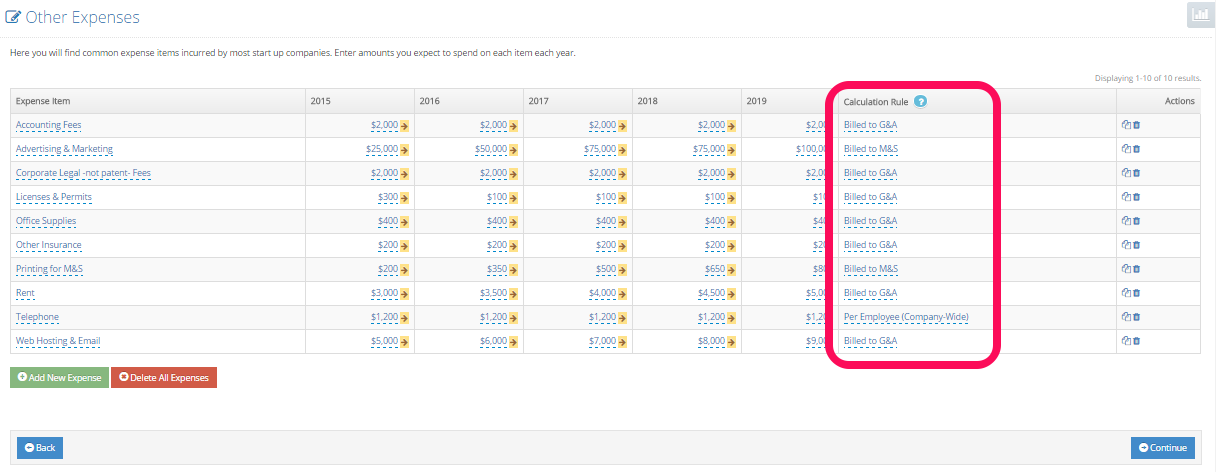

Also tell us how you want us to interpret your entry and to what division you want the expense charged (that will enable us to organize your P&L statement properly).

Here are your choices for the calculation rules:

- Billed to G&A. We'll just use the number you entered as the amount you expect to spend and charge it to “General and Administration”. For example, your Accounting Fees might be entered as $3,000 and will be charged to G&A.

- Per Employee. We'll take the number you entered, multiply it by the number of employees you have on payroll, and charge the product to “General and Administration”. For example, you might want your Dues and Subscriptions to be entered as $150 and set to “per employee;” that way, you enter this just one time and you don't have to worry about it again. Just change your employee count, and this expense will change automatically.

- Per G&A Employee. We'll take the number you entered, multiply it by the number of employees you have on payroll whose salaries are being charged to G&A, and charge the product to “General and Administration”. For example, you might want your G&A Travel to be entered as $4,000 and set to “per G&A employee;” that way, you enter this just one time and you don't have to worry about it again. Just change your G&A employee count, and this expense will change automatically. This is useful when you want to have a different value for the travel per marketing and sales employee.

- Billed to M&S. We'll just use the number you entered as the amount you expect to spend and charge it to “Marketing and Sales”. For example, your Advertising might be entered as $120,000 and will be charged to M&S.

- Per M&S Employee. We'll take the number you entered, multiply it by the number of employees you have on payroll whose salaries are being charged to M&S, and charge the product to “Marketing and Sales”. For example, you might want your M&S Travel to be entered as $15,000 and set to “per M&S employee;” that way, you enter this just one time and you don't have to worry about it again. Just change your M&S employee count, and this expense will change automatically. This is useful when you want to have a different value for the travel for employees other than M&S.

- Billed to M&P. We'll just use the number you entered as the amount you expect to spend and charge it to “Manufacturing and Production”. For example, your Cleaning Supplies might be entered as $1,000 and will be charged to M&P.

- Per M&P Employee. We'll take the number you entered, multiply it by the number of employees you have on payroll whose salaries are being charged to M&P, and charge the product to “Manufacturing and Production”. For example, you might want your M&P Travel to be entered as $500 and set to “per M&P employee;” that way, you enter this just one time and you don't have to worry about it again. Just change your M&P employee count, and this expense will change automatically. This is useful when you want to have a different value for the travel for employees other than M&P.

- Billed to R&D. We'll just use the number you entered as the amount you expect to spend and charge it to “Research & Development”. For example, your Printing for R&D might be entered as $3,000 and will be charged to R&D.

- Per R&D Employee. We'll take the number you entered, multiply it by the number of employees you have on payroll whose salaries are being charged to R&D, and charge the product to “Research & Development”. For example, you might want your R&D Travel to be entered as $5,000 and set to “per R&D employee;” that way, you enter this just one time and you don't have to worry about it again. Just change your R&D employee count, and this expense will change automatically. This is useful when you want to have a different value for the travel for employees other than R&D.

When you open a new plan in Offtoa, Offtoa seeds the plan with a list of typical expense accounts (click on the links below). Feel free to use these, or if you prefer, rename them, or even delete them and replace them with expense accounts that you like. Here are the expense accounts that Offtoa starts you off with, along with some advice on values to enter:

- Rent.

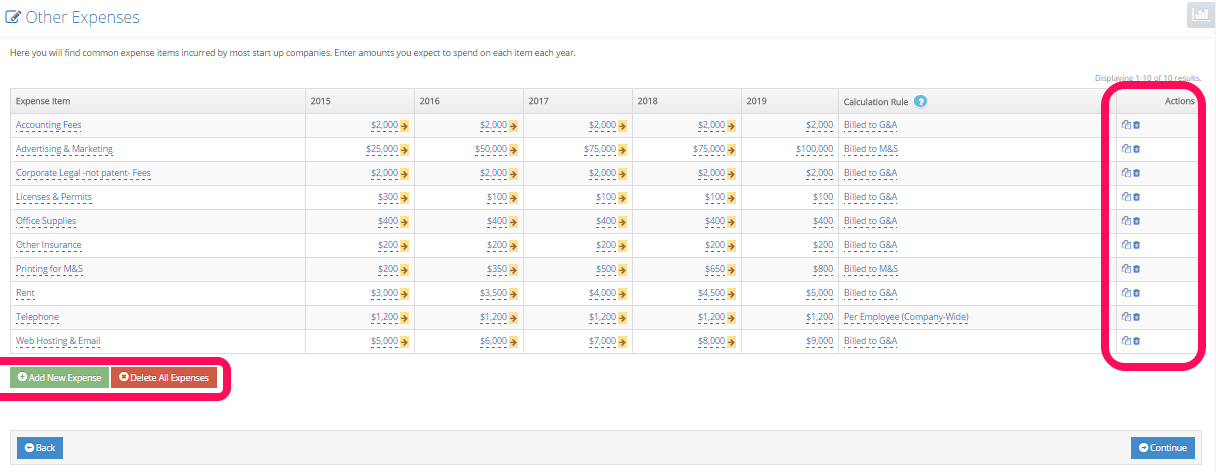

If you want to delete an expense row, press the delete icon in the Actions column circled in the figure below. If you want to make a copy of an existing expense row, press the copy icon in the Actions column circled in the figure below. If you want to add a new expense press the green 'Add a New Expense' button. If you want to delete all the expense rows, press the red 'Delete all Expenses' button.

Additional Questions:

How should I handle tenant improvements?

Can I just expense a computer or other major purchase?

How do I add manufacturing overhead costs as COGS?

How do I add or remove a year (column) to/from the expenses table?