User Tools

Raw Materials

Help with This Page:

Once you select products you want to sell, you need to determine how you are going to acquire those products so you can sell them. This screen exists because costs of purchasing raw materials that make up those products are handled differently (from an accounting perspective) than other expenses. The costs of purchasing raw materials are part of costs of goods sold (aka COGS). COGS are highly dependent on the type of industry that you are in. For example,

- If you are in either retail or wholesale/distribution, you are generally in the business of purchasing products, generally in bulk quantities, and selling them, generally in smaller quantities, to your customers. The costs of purchasing these products are COGS, and are considered raw materials.

- If you manufacture one or more of your products, you purchase raw materials and/or partially assembled components, generally in bulk quantities, you assemble those materials and/or components together using some process to create your finished products, which you then sell to customers.

- If you provide a service that you charge customers for, you may include delivery of some tangible products, e.g., you sell training courses but you include a physical notebook and/or textbook with the course delivery. The costs of purchasing these products are COGS, and are considered raw materials.

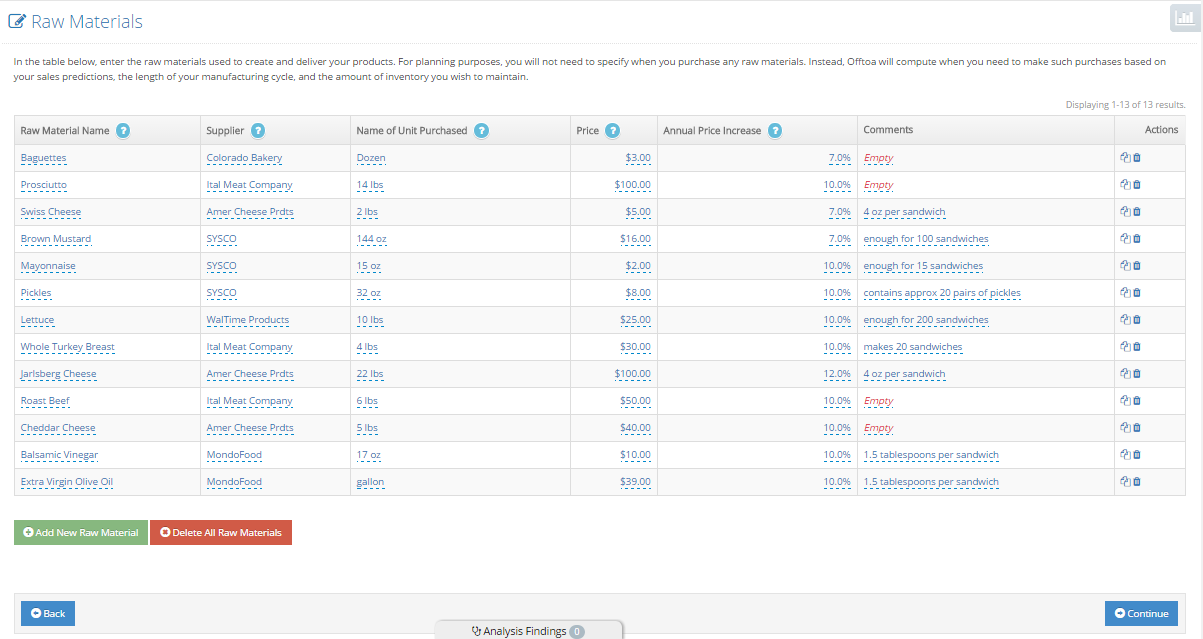

On this page, you should enter assumptions about each raw material you plan to purchase. Here is what the screen looks like:

Here is the information that you should enter into each row:

- Name of raw material. Include all ingredients that you need to manufacture your products. If you are a retailer/wholesaler/distributor, include all bulk purchases of products. Don't forget to include any packaging needed for your product that is necessary before it goes out of your door. Also, if you are required to ship your finished product to your customer, the cost of shipping is generally considered to be a cost of goods sold, so include that also as a raw material.

- (Name of the) Unit of purchase (also called “purchase lot size”). In what unit do you purchase this raw material? For example, do you purchase it by the truckload? The palette? The case? The 55 gallon drum?

- Supplier name. From what supplier do you expect to purchase this material? Although you will likely have multiple suppliers to reduce your business risk, you only need to record the name of your primary supplier for the purposes of the financial model.

- Purchase price. What net price do you expect to pay for this raw material in this unit of purchase from this supplier? Factor in any quantity discounts that you expect. If you will be purchasing in small quantities initially (and thus enjoying no quantity discounts), but expect to purchase in larger quantities later, factor expected future discounts into the annual price (de-)increase (the next assumption).

- Annual price increase. What percentage increase do you expect to have to pay each year after the first year? For example, if you are purchasing, say, sorghum and expect the price to increase by 15% per year, enter this assumption as +15%. If you are purchasing, say, aluminum sheet and expect the price to decrease by 10% per year, enter this assumption as minus 10%. In these two cases, let's say you will start off buying in small quantities, but in later years, you will be purchasing in larger and larger quantities and thus receiving 2% additional quantity discounts each year, then enter the sorghum annual price increase as +13% (i.e., 15% for the expected price increase less 2% for the expected discount) and the aluminum sheet annual price increase as -12% (i.e., -10% for the expected price increase less 2% for the expected discount).

Additional Questions:

What are the various 'units' that Offtoa asks for?

How do I handle outsourced manufacturing?

How do I relate raw materials to products I sell?