User Tools

Customer Payments

Help with This Page

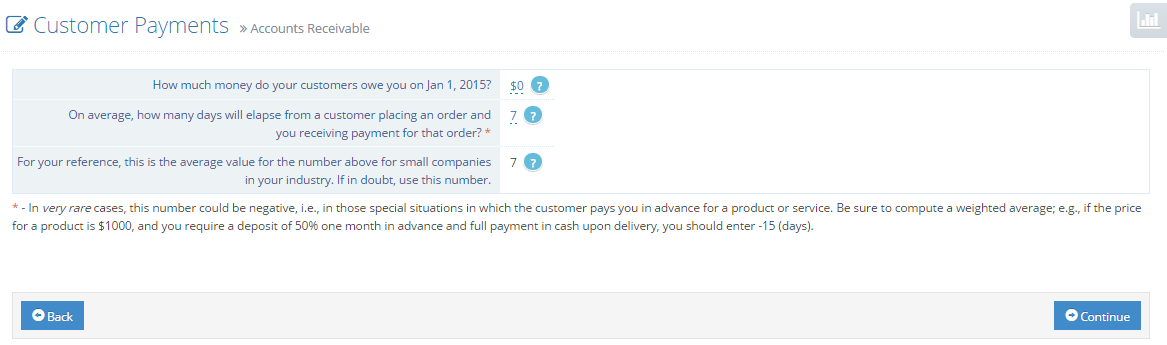

This is the screen where you can describe the details of how you will be paid by your customers.

Many small companies fail to plan their cash flow. Imagine two companies, Company A and Company B, which are in identical businesses with identical revenues of $10M per year and annual profits of $1.5M. The only difference is that Company A must pay its suppliers immediately and its customers pay their bills within 30 days of purchasing products and receiving invoices from the company. Meanwhile, Company B must pay its suppliers within 30 days of receiving supplies and its customers pay their bills online immediately upon ordering. Due to these cash flow differences, Company A could require more than $1M more funding than Company B.

Fundamental to the success of many small companies is their cash strategies. You need to specify values for two key assumptions on this screen:

- What are A/R at the beginning of the current (i.e., at the beginning of the modeling period) fiscal year? This is used just to get the first month's A/R on the balance sheet correct. If you are starting Offtoa at the very beginning of your company's existence, this will be zero.

- Average days outstanding for payments you receive from customers (aka A/R). On average, in how many days will your customers pay you? If you do all your business online and your customers enter credit card numbers to place an order, you will be paid immediately, and this assumption should be set close to zero. If you are a B2B business and are expected to invoice customers, who then pay by check within 45 days, then this assumption should be set to around 45. If you have a mix of customers, use a weighted average, weighted by volume and dollars.

In addition, Offtoa displays the average accounts receivable for companies in your industry. You should compare your entry with this value.

Here is what the screen looks like: