User Tools

Investments

Help with This Page

This is the screen where you can describe the details of any investment money you wish to take in from others. As a founder of a start up, you should be aware that only a very few ways exist that the company can get money. To learn about these ways, see the blog post How a Start Up Gets Money? If you have decided to not seek investments to get your company started, you will still need to create what is called a “founders' round.” See the answer to the question “Why do I need a founders' round?” below.

For most start-up companies, the entrepreneurs will have no way to know how much money they'll need from investors until they generate the first few iterations of their financial plans. Many users of Offtoa therefore leave this screen blank initially. They complete all the revenue and expense assumption screens, then determine how much money they need to raise from outside sources (see the blog post How Much Money Should You Ask Investors For?), and then return to this screen to enter the actual assumptions.

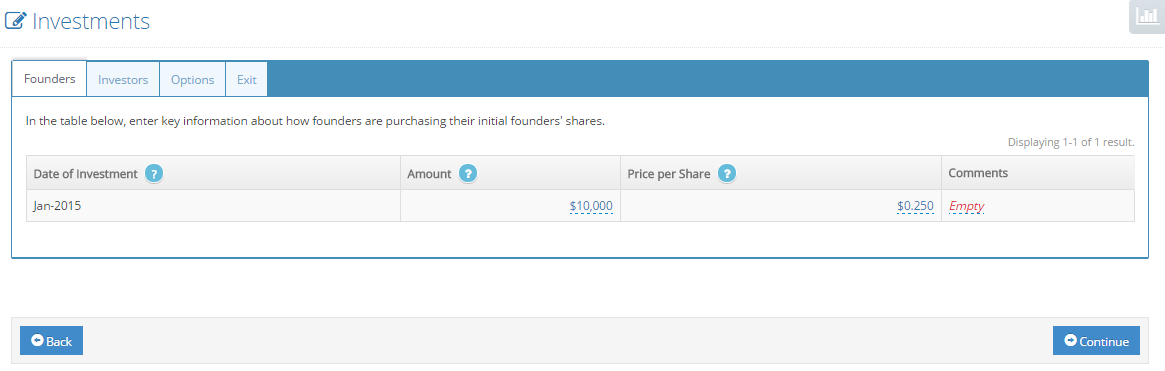

First Tab on this Page: Founders

The first tab is where you will enter the information about how the founders of your company will (or did) acquire their ownership in the company. This is a necessary step for all companies. For this round, here are the assumptions you need to enter:

- Investment Amount. How much total money do you want to raise during this particular round. Usually this is a small amount of cash, just what is needed to get the company started, but could be larger.

- Date of Round. On what month and year do you expect this event to occur?

- Price per Share. This assumption defines the price at which each share of the company is being sold. See the answer to the question “What should my price per share be?” below. If you assume there will be 1,000,000 founders' shares, simply divide the amount being raised during this round by 1,000,000 to get this price per share.

What should you do if you have a founders' round after the founding of the company? See Additional Questions below.

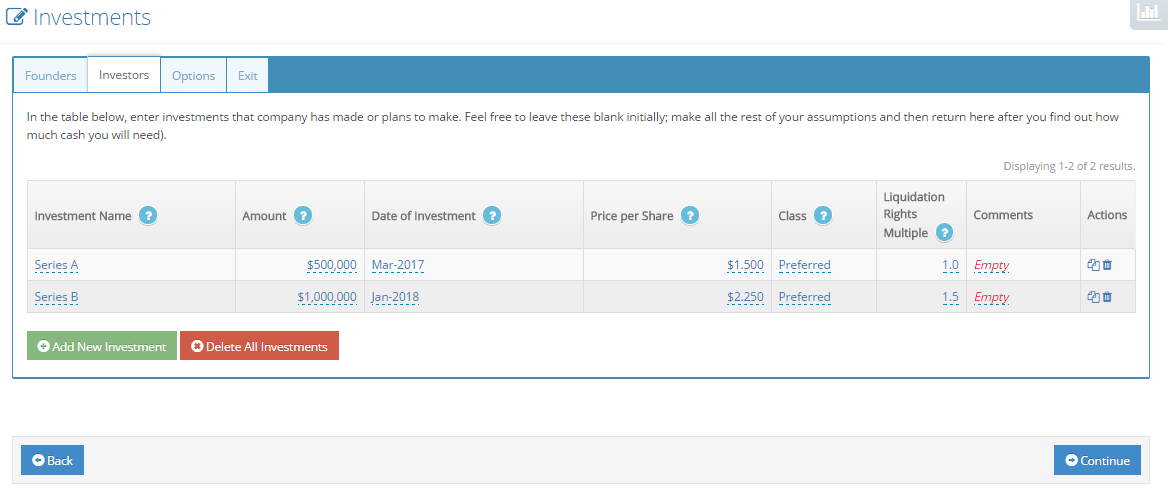

Second Tab on this Page: Investors

Here are the assumptions you need to enter to fully describe each subsequent investment round:

- Name of Investment Round. This is just the name to be used by you so you can remember which round is which. Typically, the major rounds of investment are called Series A, Series B, Series C, and so on. All investors in a particular series must have identical terms.

- Investment Amount. How much total money do you want to raise during this particular round.

- Date of Round. On what month and year do you expect to close this round? Generally, once an investment round opens, it remains open for a few weeks to a few months and eventually closes. The date being requested here is the date of the closing of the round (Offtoa makes the simplifying assumption that all rounds end on the first day of a month). The specific terms of the investment (likely drafted by your attorney) will disclose whether or not you are allowed to make incremental closes prior to the final close of the round.

- Price per Share. You are selling a part of your company. This assumption defines the price at which you plan to sell each share of the company. See the answer to the question “What should my price per share be?” below.

- Class. Are you planning on selling common or preferred stock? See the answer to the questions “What is common vs. preferred? Which should I offer investors?” below.

- Liquidation Rights Multiple. If preferred stock, what multiple of their purchase price will investors receive upon a liquidity event prior to general distribution of the remaining funds to all shareholders? According to Wasserman's Founder's Dilemmas, Series A investors in 78% of all start-ups that raised external investments had a liquidation multiple of 1; 9% had a liquidation multiple of 1.1 to 2; 5% had a liquidation multiple of 2.1 to 3; and 8% had a liquidation multiple of greater than 3.

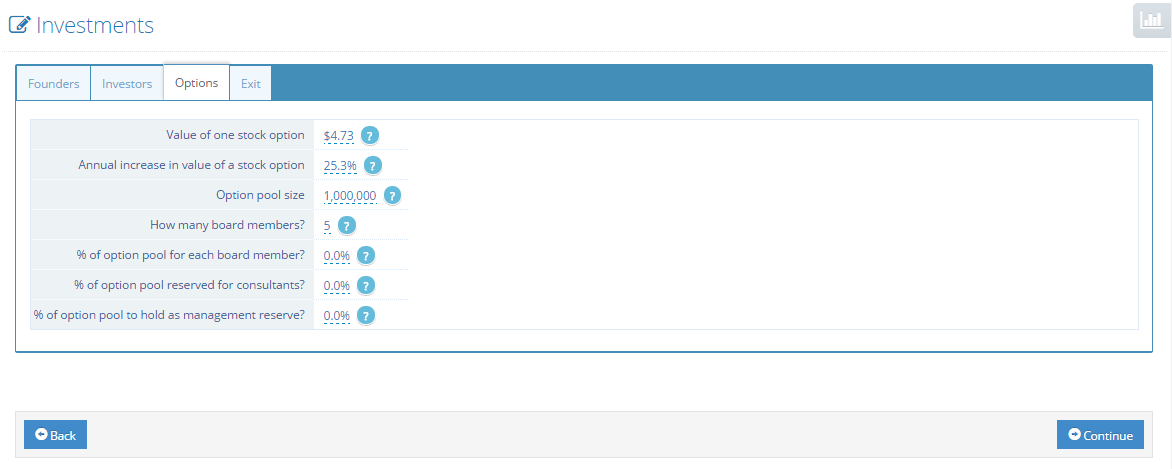

Third Tab on this Page: Options

This is the page where you will set up the option pool for rewarding employees (and others) with equity in the company. The first three fields are the most important:

- Current value of one stock option: When you want to reward individuals (whether employees or consultants), it is helpful to think about the economic value of an option. Notice that this is not the strike price; the strike price (aka exercise price) is stated in the stock option grant and is the price that the option holder would pay to exercise the option, and thus convert the option into an actual share of the company. It is also not the price the stock would be worth at the time of the exercise (for a variety of reasons, not the least of which is that we don't know when the option holder will exercise the option nor what the company would be worth at that time). It is also not the difference between these two prices, although that's closer to the right concept of economic value; after all, if the option holder pays $1.00 and receives a share worth $5.00, one could say that the economic value is $4.00. However, the true economic value of the option must consider all the factors of time value of money, probabilities of the company's success, risk, and so on. For the purposes of a start-up business's financial plan, there is no need to compute a precise economic value of an option using, say, Black-Scholes. It suffices to state some economic value for an option so that you can compute equitable option packages for employees and others. Here is one approach to determining the “right” economic value:

- Select the option pool size you want based on your management philosophy. For example, if your founders are purchasing 1,000,000 shares and you want your employees and founders to 50/50 partners, then create an option pool with 1,000,000 shares.

- Select some economic value for one stock option. (Try $1.00)

- State all the rest of your assumptions concerning values of initial option packages for new employees (on your Assumptions/Costs/Personnel/Employees screen) and whether you plan to pay all your employees with cash (on the advanced tab of your Assumptions/Costs/Personnel/Employees screen).

- Examine your capitalization table. Specifically, see what happens to the number of options granted.

- If twice as many options are distributed than the desired size of the option pool, then double the economic value. If half as many options are distributed than you want to distribute, then halve the economic value, etc.

- Annual increase in stock option value. In the previous assumption, you set the first year's value of a stock option. At what rate do you expect this to increase in subsequent years? If you expect the company to double its value each year, then you might set this to 100%. If you expect the company to triple its value each year, then you might set this to 200%. Note the effect of setting this to, say, 100%, and set employee expectations accordingly: An employee being awarded 25,000 stock options one year should expect to be awarded 12,500 stock options the following year, and it would be an equivalent award.

- Option pool size. Select the option pool size you want based on your management philosophy. For example, if your founders are purchasing 1,000,000 shares and you want your employees and founders to be 50/50 partners, then create an option pool with 1,000,000 shares.

The remaining four fields describe some uses for the option pool other than rewarding of employees:

- How many board members. How many members do you expect to have on your board of directors?

- Percent of option pool reserved for each board member. In most start-ups, directors are compensated with stock options. This assumption gives you a place to reserve a percent of the total option pool for each board member. As a general guideline, each board member should receive roughly 10% of what the CEO receives. So, here is an example: Let's say that the CEO is to be rewarded with no cash compensation and stock options corresponding to 18% of the option pool after working for three years (excluding any equity that s/he may have received as a founder or that s/he may have purchased as a private investor). Then, each member of the board of directors should be rewarded with no cash compensation and stock options corresponding to 1.8% of the option pool in return for his or her services. This is not a hard and fast rule, but is a good general guideline.

- Percent of option pool reserved for pool of consultants. Most start-ups need to hire consultants but have little cash. One way to solve this problem is to compensate them with stock options. It is not a perfect solution (it may create a taxable event for the consultant, and it has the potential to give company ownership to individuals without a long-term commitment to the company) but it may be the only way for the start-up to get the work it needs to have done. This assumption gives you a place to reserve a percent of the total option pool for consultants.

- Percent of option pool for management reserve. Situations will arise when management wants to have options available to mete out that were not planned. This assumption makes sure you have some reserved for such special situations.

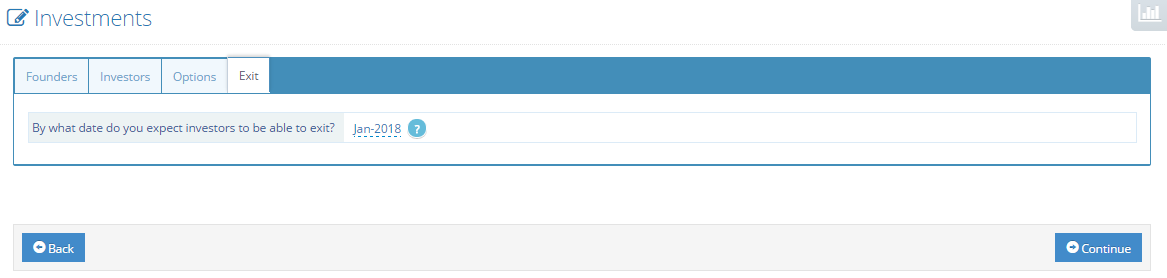

Fourth Tab on this Page: Exit

Just one item to complete on this tab:

- Liquidity date. If you are planning a liquidity event (such as an acquisition or an Initial Public offering - IPO), when do you expect it?

Additional questions:

How does a start up company get money?

Why do I need a founders' round?

How much money should I ask for from investors?

What is the right timing for investment rounds?

What should my price per share be?

Should I offer common or preferred shares to investors?

Can founders invest in the company after the founder's round?

How do I handle in-kind investments?

Can I pay off a loan with an investment round?

How to create a warrant in Offtoa?

Should I get a loan or ask for investments?

How do investors value my startup?