Loans

Help with This Page

This is the screen where you can describe the details of any loans you wish to take in from others. As an individual leading a company, you should be aware that very few ways exist for a company to get money. To learn about these ways, see the blog post How a Company Gets Money?

For most companies, the leaders will have no way to know how much money they'll need from lenders until they generate the first few iterations of their financial plans. Many users of Offtoa therefore leave this screen blank initially. They complete all the revenue and expense assumption screens, then determine how much money they need to raise from outside, and then return to this screen to enter the actual assumptions.

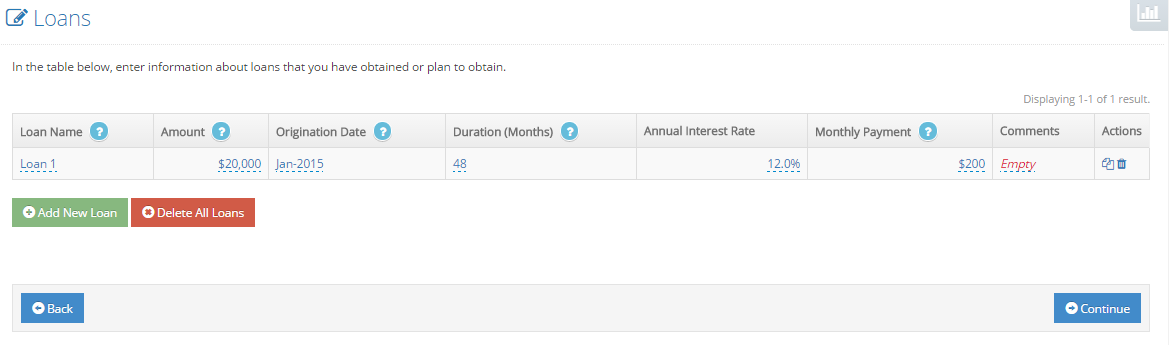

Here is what the screen looks like:

For each loan, here are the assumptions, you need to enter:

- Loan Name. This is just a name to be used by you so you can remember which loan is which. For example, you might use the name of the lender (e.g., Bank of America), or the underwriter (e.g., SBA), or the personal collateral used (e.g., Rolex watch).

- Loan origination date. The date the loan was effective. Corresponds to when the company received funds.

- Amount of loan. The amount of money that the company received from the lender.

- Interest rate. The annual percentage rate (APR) for the loan.

- Duration, aka term. The number of months over which the loan is being given.

- Monthly payment amount (P). If this is a typical bank loan, the monthly payment can be calculated easily from the amount of the loan (L), monthly interest rate (c), and duration (n) using the formula (it is designed to pay off the loan in full during the loan's duration):

P = L × c × (1 + c)n / ((1 + c)n - 1)

However, some loans acquired by small companies could include no monthly payments (it is designed so that the company pays off the loan in full - the principal plus all accumulated interest - at the end of its duration in one “balloon payment”), in which case,

P = 0,

or could require the company to make monthly payments of interest only (it is designed so that the company pays off the principal of the loan in full at the end of its duration), in which case,

P = L × c. - Convertible? See Additional Questions below.

- Warrants? See Additional Questions below.

Additional Questions (about loans in general):

Should I get a loan or ask for investments?

How much money should I ask for from lenders?

Additional Questions (about specialized loans):

How to create a convertible loan in Offtoa?

How to create a warrant in Offtoa?

Can I create a loan where loan payments start after a year?

Can tenant improvements from the landlord be considered loans?