Cost of Goods Sold

Help with This Page:

This screen gives you the ability to describe how the materials you defined on the raw materials screen (see Raw Materials) are consumed in the delivery of products to customers. It gives you the power to transform the raw material data into costs of goods sold (COGS).

We provide three tabs for you on this COGS screen that organize assumptions into three categories. We recommend that you complete them in this order:

- Assumptions about how materials you plan to purchase relate to products you sell to customers (Note: you define the actual raw materials on the screen called “raw materials”).

- Assumptions about the amount of waste/spoilage.

- Assumptions about your manufacturing timing and inventory timing.

First Tab on this Page: Raw Materials by Product OR Products by Raw Materials

You can toggle between the two versions of this first tab by clicking on the blue buttons labeled 'View Raw Materials by Product' or 'View Products by Raw Materials' at the bottom of the screens (see pictures of screens below)

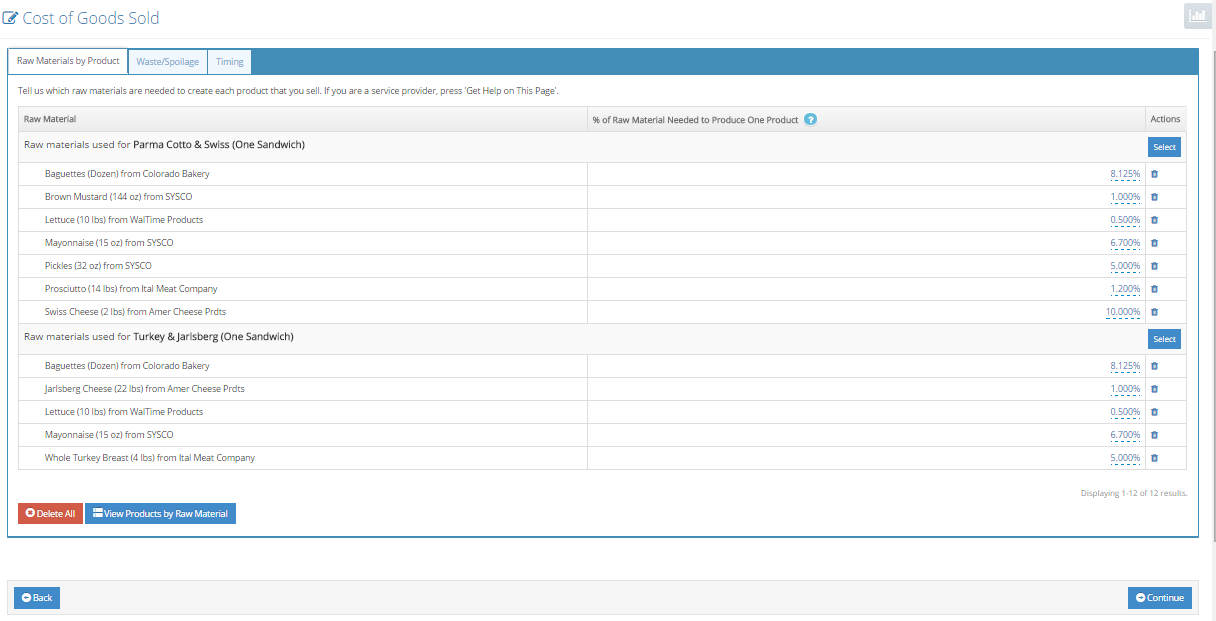

Raw Materials by Product

To add a new raw material to a product, press the blue 'Select' button to the right of the product to which you want to add the raw material.

Here are the assumptions concerning how raw materials you purchase relate to products you sell to customers:

- For each product, tell us which raw materials are needed, and what percentage of the unit of purchase of that raw material is needed to create one unit (for sale to a customer) of the product. Here are three examples:

- You are a retailer and purchase cartons of a 20 candy bars, which you sell as individual bars to customers. Assume that your raw material is “bulk candy bars,” the purchase lot size is a “20 carton,” the product is a “candy bar,” the unit of sale (to the customer) is a “bar.” Then in this step you would specify that a “candy bar” product needs 5% of a “20 carton” of “bulk candy bars.”

- You are a manufacturer and purchase palettes of 8 foot long 2“x4” pine lumber, which you assemble with nails to produce sheds, which you sell to retailers. Assume that your raw material is “2”x4“x8' pine lumber,” the purchase lot size is a “palette of 500,” the product is a “shed,” the unit of sale (to the customer) is a “shed.” Then in this step you would specify that a “shed” product needs 12% of a ““palette of 500” of “2”x4”x8' pine lumber.“ You would also have to specify what percentage of the bulk purchase of nails would be required to produce one shed.

- You provide 3-day courses to your customers and allow a maximum of 30 students per course. As part of those courses, you provide a notebook to each student. You purchase notebooks from your supplier is boxes of 12 notebooks. Then in this step you would specify that a “3-day course” needs 250% of a “box of notebooks”.

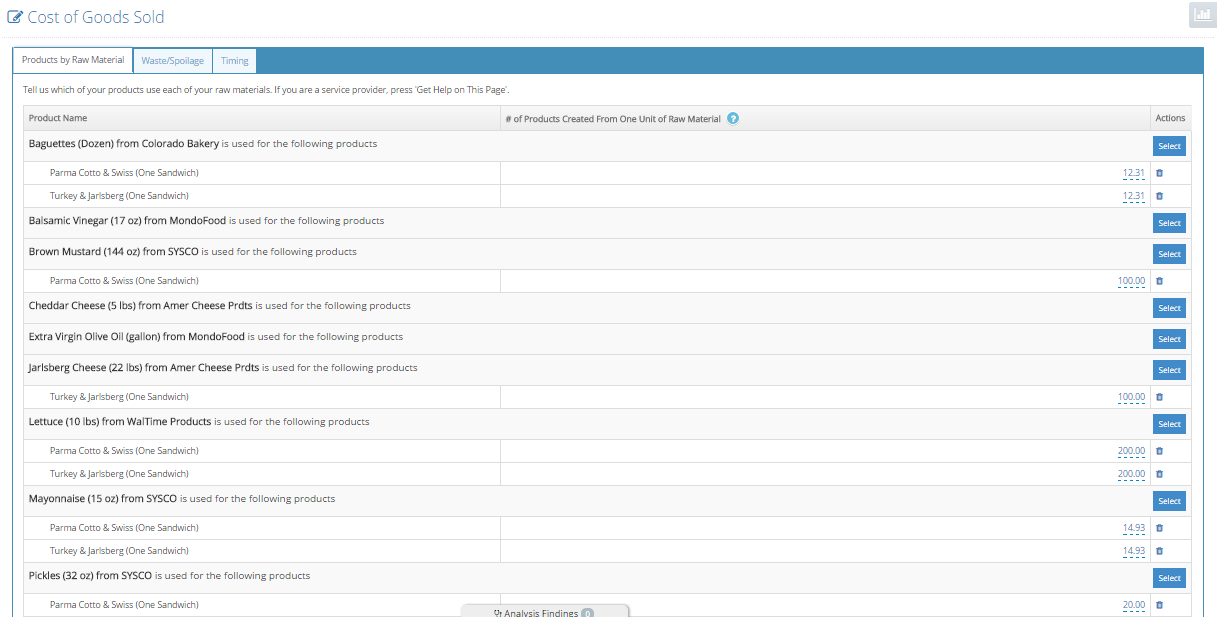

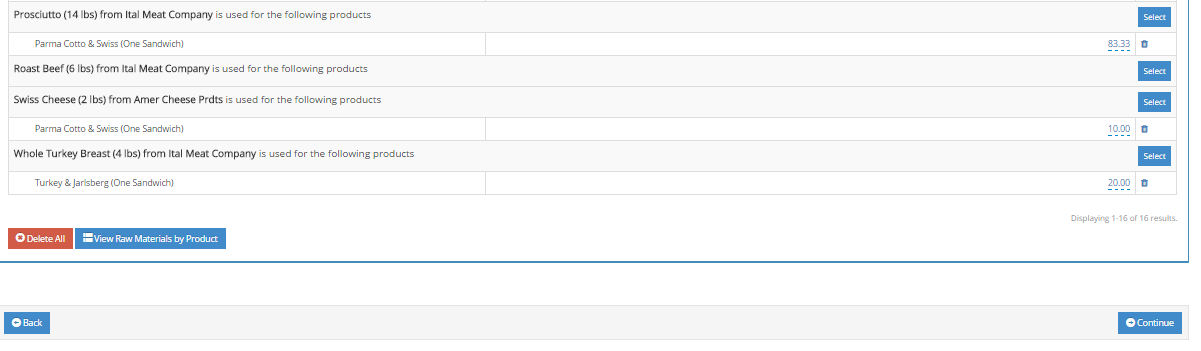

Products by Raw Material

To add a new product to use a raw material, press the blue 'Select' button to the right of the raw material to which you want to add the product.

Here are the assumptions concerning how products you sell to customers use each of your raw materials:

- For each raw material, tell us which products use that raw material, and how many products (for sale to a customer) can be satisfied with one unit of purchase of that raw material. Here are three examples:

- You are a retailer and purchase cartons of a 20 candy bars, which you sell as individual bars to customers. Assume that your raw material is “bulk candy bars,” the purchase lot size is a “20 carton,” the product is a “candy bar,” the unit of sale (to the customer) is a “bar.” Then in this step you would specify that a “20 carton” of “bulk candy bars” can create 20 “candy bar” products.

- You are a manufacturer and purchase palettes of 8 foot long 2”x4“ pine lumber, which you assemble with nails to produce sheds, which you sell to retailers. Assume that your raw material is “2”x4”x8' pine lumber,“ the purchase lot size is a “palette of 500,” the product is a “shed,” the unit of sale (to the customer) is a “shed.” Then in this step you would specify that a ”“palette of 500” of “2”x4“x8' pine lumber” is sufficient to construct 8 “shed” products.

- You provide 3-day courses to your customers and allow a maximum of 30 students per course. As part of those courses, you provide a notebook to each student. You purchase notebooks from your supplier is boxes of 12 notebooks. Then in this step you would specify that each “box of notebooks” supplies .4 “3-day courses.”

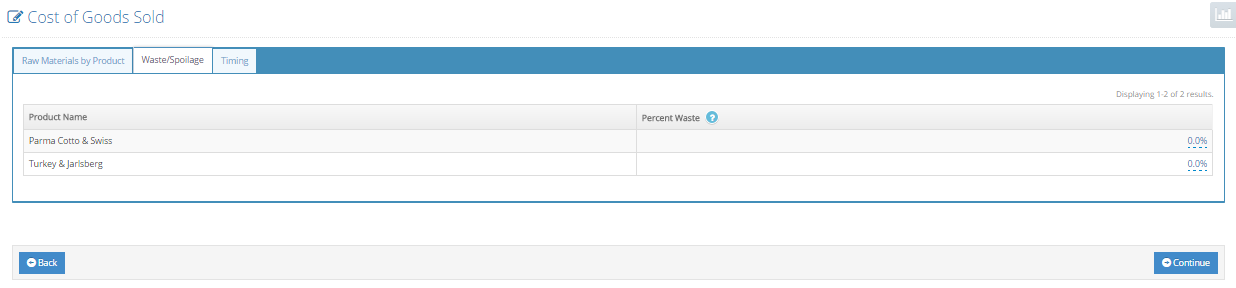

Second Tab on this Page: Waste/Spoilage

Here are the assumptions concerning waste/spoilage:

- Percentage waste/spoilage. For each product, what percent of the product (and its raw materials) will be wasted/spoiled, or obsoleted rather than sold to customers?

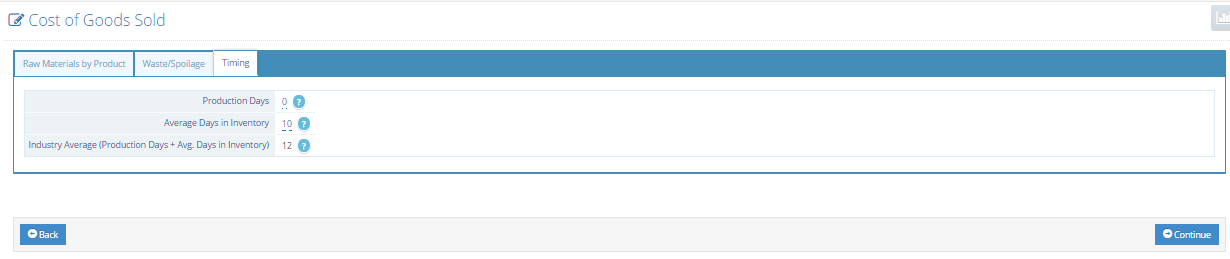

Third Tab on this Page: Timing

In addition, Offtoa displays the average timing (manufacturing plus inventory) for companies in your industry. You should compare the sum of your two entries with this value.

Here are the assumptions concerning manufacturing and inventory timing:

- Production days. On average, how many days will it take to manufacture your products? If you are not a manufacturer, this is always zero.

- Inventory days. On average, how many days will raw materials, parts-in-process and finished goods remain in inventory? If you are not a manufacturer, then how many days on average will products be in inventory? Use a weighted average, e.g., if you expect 1,000 $100 items to remain in inventory an average of 60 days and 300 $50 items to remain in inventory an average of 30 days, use 56 days, i.e.,